Your 2nd Chance Mortgage

Your 2nd Chance Mortgage

4415 West Harrison Suite 326 Hillside, IL 60162 Phone: 773-677-6460 Fax: 773-439-2450 Email: libmtg@yahoo.com NMLS 1807234

Main Menu Mortgage Forms Mortgage Programs Other Services Offices & LOs Logins & Passwords Residential Main Menu

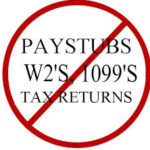

Non Owner No Income – NONI Loan Programs

Non Owner No Income – NONI Loan Programs

Because these are Non QM Programs we can legally pay any one an Origination Fee.

Alternative Documentation Program - The Popular (#R101 )- Vice -90% For Good Credit Borrowers.

Alternative Documentation Program – For Good Credit Borrowers.

.

.

* FICO 660

* Max LTV 90%

* 12/24 mo. 1099, P&L

* Asset Utilization, WVOE

* 12/24 mo. Bank Statements

* O/O, 2nd Home, Investment

* Cash out up to $1,000,000

* Max Loan Amount up to $5,000,000

Alternative Documentation Program - The Flex Program (#R106) 90% LTV / $3M For Imperfect Credit Borrowers

90% LTV / $3M Alternative Documentation Program – For Imperfect Credit Borrowers

* Max LTV 90%

* Up to 50% DTI

* Min. FICO 580

* 12/24 mo. 1099 or P&L

* 12/24 mo. Bank Statement

* O/O, 2nd Home, Investment

* Max Loan Amount $3,000,000

* Up to 10,000,000.00 0n an exception Basis

* Foreclosure, Deed in Lue, Short Sale, BK – 24 Month

Bank Statement Program -Self Employed (T101)

For those who are self-employed and looking to own a home.

* DTI up to 55%

* Credit scores down to 600

* Recent Credit Events Allowed

* Loan amounts up to $4,000,000

* Non-Warrantable Condos allowed

* Max LTV up to 90% (purchase only)

* Multiple financed properties allowed

* Personal and Business Bank Statements allowed

* 2nd Home and Investment properties up to 80% LTV

* 3 month, 12 month and 24 month Bank Statement options

* 7/6 and 10/6 ARM, 15, 30, and 40 FRM (40 year term IO only)

Program Matrix

Cash Flow Loan Program (#P101)

With a wide variety of loan terms options up to 30 years, our rental loans are an

attractive option for rental property investors. Rates start at just 5.49%.

-

Purchase or Refinance

-

Interest-Only Options

-

$75,000 to $5,000,000

-

Coin - Qualify with Crypto (#R106)

COMMING SOON

Construction Loans-Ground Up (#P102)

With housing supply lower than ever, more borrowers are looking to ground-up

construction to raise their investment game. We offer competitive rates from 9.25%.

-

New Construction

-

Up to 70% LTV

-

Up to $5,000,000

-

12-Month Loan Term

-

Commercial - Mixed Use, Office, Rehabs (#P103)

Purchase, refinance, or renovate commercial properties. Our commercial loans start at 8.5%

and can be used on multi-family, retail, office, and mixed-use buildings.

-

Purchase or Refinance

-

Renovation

-

$250,000 to $5,000,000

-

12-Month Loan Term

-

Crisis Impacted Program - Snap (#R102) - 90% LTV

Fix & Flip 85% Purchase 100% Rehab (#P101)

Our Fix & Flip lending program is our most popular offering, with rates from 7.5%,

LTV up to 85%, and coverage of up to 100% of your client’s rehab budget.

-

Purchase or Refinance

-

Renovation

-

$75,000 to $3,000,000+

-

12-Month Loan Term

-

Foreign - International Home Buyers (#R103)

The Foreign – International Home Buyers

* Max LTV 75%

* Standard Doc & DSCR

* Max Loan Amount $2M

* Assets in Foreign Entity OK

* Third Party Letter for Income

..

* 2nd Home & Investor Property

.

* 6 Months PITI Reserves required

Full Doc Loan down to 600 FICO (#T103)

For those who file income the traditional way looking to expand their loan qualifications.

* DTI up to 55%

* Credit scores down to 600

* All occupancy types allowed

* Recent credit events allowed

* Loan amounts up to $4,000,000

* Non-Warrantable Condos allowed

* Max LTV up to 90% (purchase only)

* Multiple financed properties allowed

* 7/6 and 10/6 ARM, 15, 30, and 40 FRM (40 year term IO only)

Program Matrix

Full Doc Program up to 90% LTV to $3,000.00 - The Guru Program (#R104) - For Excellent Credit Borrowers

90% LTV to $3,000,000, Full Documentation Program – For Excellent Credit Borrowers.

* Max LTV 90%

* Up to 55% DTI

* Min. FICO 660

* Cash-Out to $1M

* Interest Only Available

* Max Loan Amount $3,500,000

* 1 or 2 year Full-Doc for Self employed

* O/O, 2nd Home, Investment Properties

* Up to 10,000,000.00 0n an exception Basis

Multi Unit Property

No Income / DSCR - The Zero (#R105) 80% LTV / $3.5M Business Purpose Loans -

80% LTV / $3.5M Business Purpose Loans – No Income / DSCR

* No Ratio

* Max LTV 80%

* Min. FICO 600

* DSCR < 1.00 OK

* Can Close in LLC

* Vacant Property OK

* Cash-Out $1,000,000

* Investment Properties

* Max Loan Amount $3.5M

* No Borrower Income Required

* 0 x 60 and/or Housing Event OK

Stock Option Program - Lava - (#107)

COMMING SOON

Order Credit: Click Here Contact Us: Click Here

(Must email: libmtg@yahoo.com a copy of the Signed Credit Authorization Form prior to the pull)